In today’s fast-paced financial world, planning for the future is more important than ever. Whether your goals are short-term like buying a car, or long-term like planning for your child’s education or retirement, Systematic Investment Plan (SIP) is one of the most effective tools available to achieve them.

But what exactly makes SIP such a popular choice among investors? Let’s dive deep into the key benefits of SIP and understand how it can help you build wealth steadily and smartly.

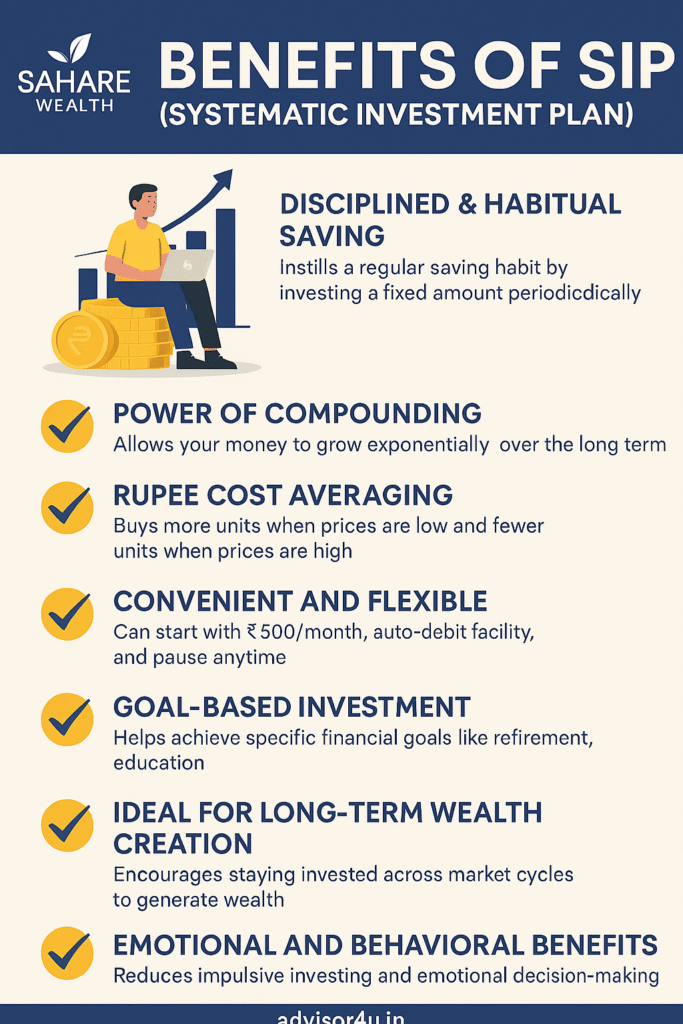

✅ 1. Disciplined & Habitual Saving

SIP encourages financial discipline by helping you invest a fixed amount at regular intervals — weekly, monthly, or quarterly. This habit of consistent investment instills a sense of financial responsibility and ensures that you’re always working towards your goals.

Example: Even ₹500/month invested regularly can grow significantly over time thanks to compounding.

✅ 2. Power of Compounding

One of the biggest advantages of SIP is that it leverages the power of compounding, where you earn returns not just on your original investment but also on the returns generated. Over the long term, this can lead to exponential growth of your wealth.

Tip: The earlier you start, the more you benefit from compounding.

✅ 3. Rupee Cost Averaging

Markets fluctuate. But with SIP, you don’t have to worry about timing the market. You invest a fixed amount every month, which means:

- You buy more units when prices are low

- You buy fewer units when prices are high

This averages out your cost per unit over time, helping reduce the impact of market volatility.

✅ 4. Convenient and Flexible

SIPs are extremely convenient:

- Auto-debit facility ensures you never miss an investment

- You can start with as little as ₹500 per month

- You can increase your SIP amount through SIP Step-Up feature

- Can be paused or stopped at any time without penalty

This makes SIP suitable for both salaried individuals and self-employed professionals.

✅ 5. Goal-Based Investment

You can align SIPs with specific financial goals:

- Child’s education

- Buying a house

- Retirement planning

- International vacation

- Emergency fund

This makes your investments more purposeful and measurable.

✅ 6. Ideal for Long-Term Wealth Creation

SIPs help investors stay invested across market cycles, which is key to generating long-term wealth. Over time, the market’s ups and downs even out, and your disciplined investments can deliver solid returns.

Data Insight: Historically, SIPs in equity mutual funds for 10+ years have delivered average returns between 10–15% per annum.

✅ 7. Emotional and Behavioral Benefits

Since SIPs are automated and regular:

- You avoid impulsive buying/selling

- You stay focused on goals

- You don’t panic during short-term market corrections

SIP instills patience, and patience leads to returns.

📈 Conclusion: SIP is Not Just an Investment. It’s a Habit for Life.

Whether you’re new to investing or a seasoned professional, SIP offers a simple, flexible, and effective way to grow your wealth over time — without needing to worry about market timing or lump sum availability.

Start small, stay consistent, and let time and discipline work their magic.

🔔 Need Help Setting Up Your SIP?

We can help you plan SIPs aligned with your unique financial goals and risk profile.

📞 Contact Today for Free Guidance – 9405908605