In today’s fast-paced financial world, investing without clear financial goals is like sailing without a compass. Whether you’re a young professional, a business owner, or nearing retirement, setting well-defined financial goals is the first step toward financial freedom. Let’s explore how you can set smart, achievable goals before making any investment decisions.

🧭 1. Understand Why You’re Investing

Before diving into mutual funds, stocks, or real estate, pause and ask:

- What do I want to achieve?

- By when do I need this money?

- How much risk can I take?

Goals could include:

- Building an emergency fund

- Buying a house

- Children’s education

- Retirement planning

- Wealth creation or passive income

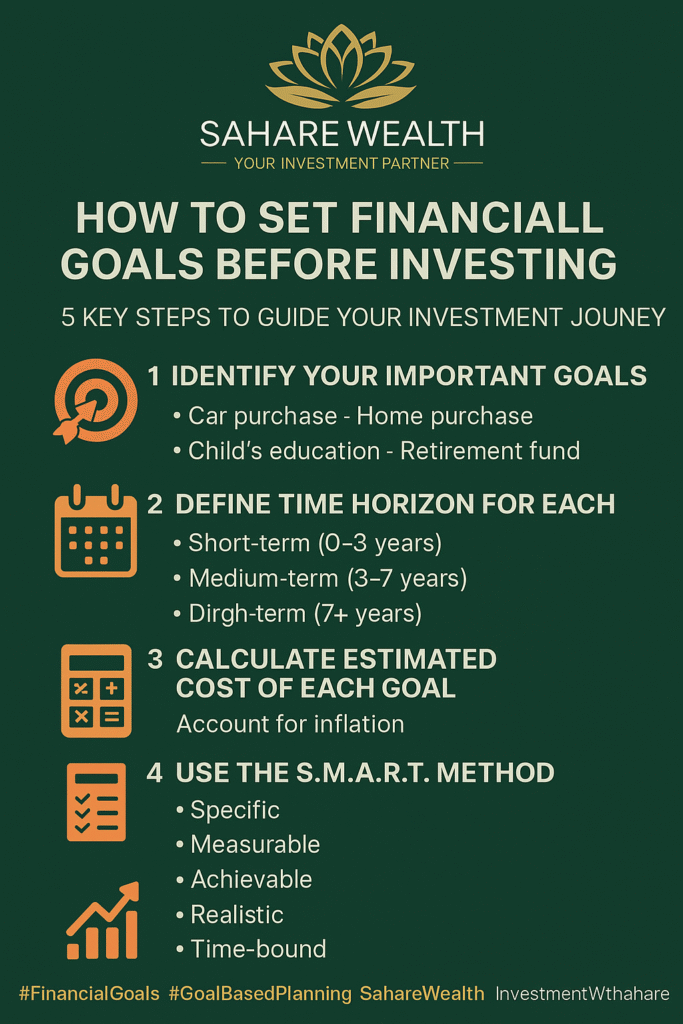

📊 2. Categorize Goals: Short, Medium & Long-Term

Short-Term Goals (0–3 years)

E.g., Vacation, emergency fund, buying a gadget.

💡 Invest in low-risk options like liquid or short-term debt mutual funds.

Medium-Term Goals (3–5 years)

E.g., Buying a car, children’s schooling.

💡 Consider hybrid or balanced mutual funds for moderate risk and growth.

Long-Term Goals (5+ years)

E.g., Retirement, child’s higher education, wealth creation.

💡 Equity mutual funds or SIPs are ideal here due to compounding benefits.

🎯 3. Make Your Goals SMART

Your goals must be:

- Specific

- Measurable

- Achievable

- Realistic

- Time-bound

📝 Example: “I want ₹10 lakhs in 10 years for my child’s college education.”

📐 4. Calculate the Cost of Your Goal

Consider:

- Current cost of the goal

- Inflation rate (usually 6–7%)

- Investment duration

💡 Use an online goal calculator or consult a financial advisor to get exact numbers.

💸 5. Link Each Goal with the Right Investment Product

Each goal demands a different investment strategy:

| Goal Type | Investment Option |

|---|---|

| Emergency Fund | Liquid Fund, FD |

| Car/Marriage (3-5 yrs) | Balanced Fund, Hybrid Fund |

| Retirement (10+ yrs) | Equity Mutual Funds, NPS |

| Passive Income | SWP from Debt/Hybrid Funds |

🧠 6. Review and Adjust Your Goals Annually

Life changes. So should your financial goals.

Set an annual reminder to:

- Check progress

- Reallocate investments if needed

- Update goals based on life events (marriage, child, job change)

🤝 Final Thought

A goal-based investment approach brings structure, discipline, and purpose to your financial journey. Don’t invest because others are doing it — invest because you have a well-thought-out goal and a plan to achieve it.

Need help setting your financial goals or choosing the right mutual funds?

📌 Let’s connect for a FREE Goal Planning Session today!