In the ever-evolving world of investments, mutual funds have emerged as one of the most trusted, flexible, and beginner-friendly ways to grow wealth. But what exactly is a mutual fund, and why is it gaining popularity among Indian investors?

Let’s break it down in simple terms.

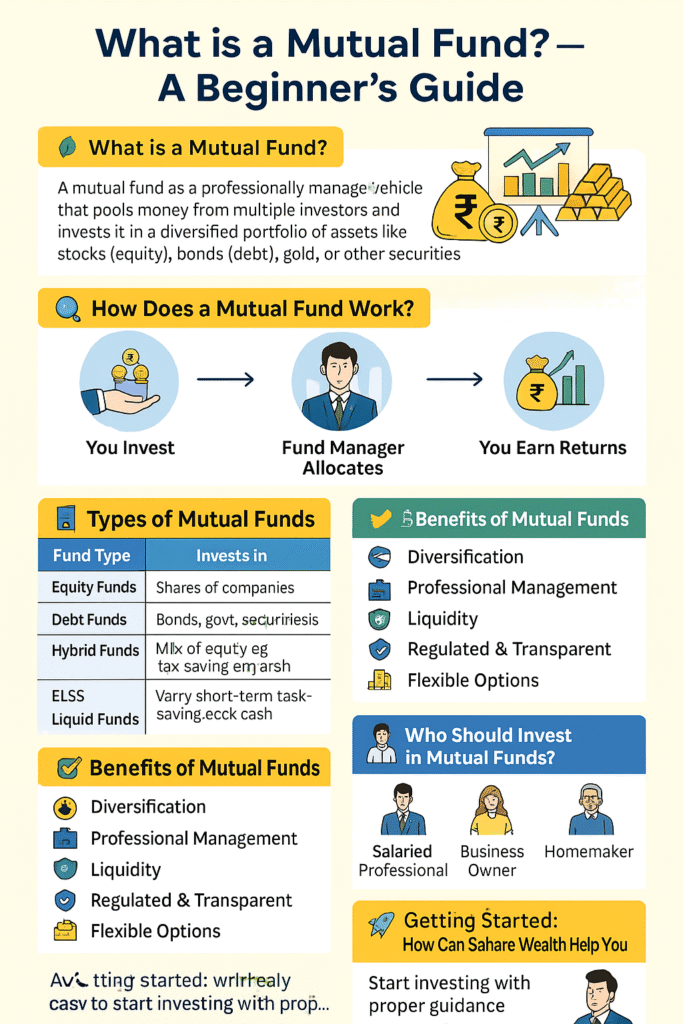

🌱 What is a Mutual Fund?

A mutual fund is a professionally managed investment vehicle that pools money from multiple investors and invests it in a diversified portfolio of assets like stocks (equity), bonds (debt), gold, or other securities, depending on the type of fund.

The key benefit? You don’t need to be an expert to invest in mutual funds. A qualified fund manager takes care of your money and aims to generate returns based on your financial goals and risk appetite.

🔍 How Does a Mutual Fund Work?

Here’s how it functions in 3 simple steps:

- You Invest – You invest a specific amount in a mutual fund (either one-time or monthly via SIP).

- Fund Manager Allocates – The fund manager uses this pooled money to invest in various securities.

- You Earn Returns – Based on market performance, you earn profits (or sometimes, losses) which reflect in your fund’s NAV (Net Asset Value).

💡 Types of Mutual Funds

To match different investor goals, mutual funds come in different categories:

| Fund Type | Invests In | Ideal For |

|---|---|---|

| Equity Funds | Shares of companies | Long-term wealth creation |

| Debt Funds | Bonds, govt securities | Stable returns, lower risk |

| Hybrid Funds | Mix of equity & debt | Balanced approach |

| ELSS | Equity + Tax-saving (80C) | Tax benefits + long-term growth |

| Liquid Funds | Very short-term instruments | Parking surplus cash |

✅ Benefits of Mutual Funds

- Diversification – Your investment is spread across multiple assets, reducing risk.

- Professional Management – Experts manage your investments.

- Liquidity – Most funds can be redeemed easily.

- Regulated & Transparent – Regulated by SEBI, ensuring investor protection.

- Flexible Options – Suitable for all goals – retirement, child education, emergency corpus, etc.

📈 What is SIP in Mutual Funds?

SIP (Systematic Investment Plan) is a method where you invest a fixed amount regularly (monthly/quarterly) instead of lump sum. It’s a disciplined way to build wealth gradually and benefit from rupee cost averaging and compounding.

👥 Who Should Invest in Mutual Funds?

Whether you are:

- A salaried professional wanting to save tax,

- A business owner looking for long-term wealth,

- A homemaker planning for family goals, or

- A retired individual seeking regular income…

There’s a mutual🚀 Getting Started: How Can Sahare Wealth Help You?

At Sahare Wealth, we help you choose the right mutual fund based on your risk profile, financial goals, and investment horizon. Our end-to-end support ensures your money works smarter, not just harder.

📞 Contact us for a free consultation and let’s plan your financial journey with confidence! fund solution for everyone.

Conclusion

Mutual funds are not just for experts. With proper guidance, even a beginner can start investing confidently. Remember, the earlier you begin, the greater your chances of achieving your financial dreams.

Ready to start your investment journey? Let us help you make informed decisions.